- vein treatme

- How Do I Choose the Best Vein Treatment

- What Qualifications Should You Look

- What Qualifications Should You Look

- How Do You Know It’s T

- Where Can You Find a Trusted Vein Tr

- What Are the Treatment Options for Varicose Veins

- Which Doctor Is Best for Varicose Vein Treatment

- What Insurance Plans Cover Varicose Vein Treatment

- When Should You See a Vascular Doctor

What Insurance Plans Cover Varicose Vein Treatment?

Varicose veins are more than a cosmetic concern for many people. They can cause pain, swelling, heaviness, itching, and even skin ulcers if left untreated. Because symptoms can interfere with daily life, patients often ask an important question: Are varicose veins covered by insurance? The answer depends on medical necessity, insurance guidelines, and the type of treatment recommended by a qualified vein specialist.

At Vein Treatment New Jersey patients receive personalized care and clear guidance on insurance coverage, treatment options, and long-term vein health.

Are Varicose Veins Covered by Insurance?

Insurance companies typically cover varicose vein treatment when the condition is medically necessary rather than purely cosmetic. Most providers require documentation showing that varicose veins cause symptoms such as pain, swelling, cramping, skin discoloration, or venous ulcers.

Insurance plans usually ask for:

- A diagnostic ultrasound confirming venous reflux

- A history of symptoms affecting daily activities

- Evidence of conservative treatment, such as compression stockings

If these requirements are met, many plans approve coverage for modern vein procedures performed at an accredited vein treatment center.

Factors That Affect Insurance Approval

Coverage varies between insurance providers, but several common factors influence approval decisions:

Medical Symptoms

Insurance plans focus on health impact. Pain, fatigue, burning, swelling, and skin changes improve the likelihood of coverage.

Conservative Therapy

Many insurers require patients to try compression stockings for several weeks or months before approving advanced treatments.

Diagnostic Testing

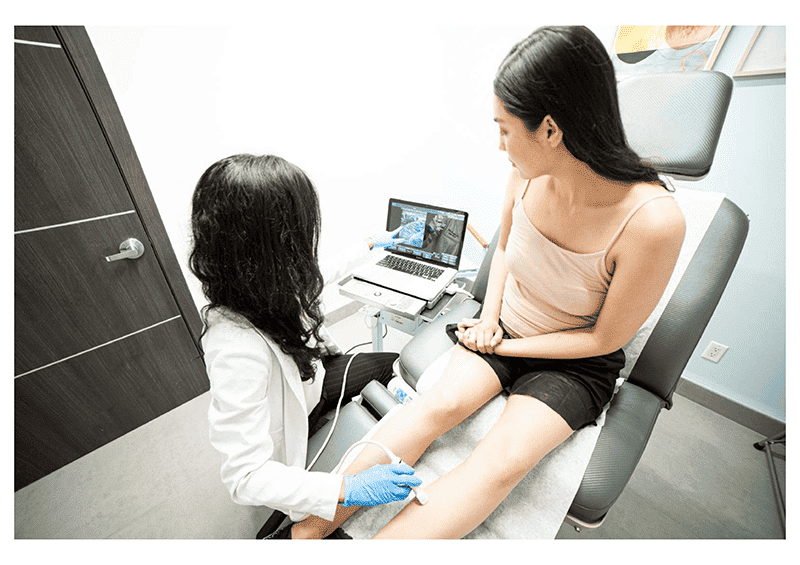

A venous ultrasound is essential. It shows whether faulty valves cause blood to pool in the veins.

Treatment Type

Some treatments qualify for coverage, while cosmetic procedures usually do not.

What Are the Treatment Options for Varicose Veins?

Understanding what are the treatment options for varicose veins helps patients make informed decisions and navigate insurance approvals more easily.

Compression Therapy

Doctors often recommend compression stockings as the first step. While they manage symptoms, they do not eliminate damaged veins.

Endovenous Laser Treatment (EVLT)

EVLT uses laser energy to seal faulty veins. Insurance frequently covers this minimally invasive procedure when medically necessary.

Radiofrequency Ablation (RFA)

RFA closes diseased veins using heat. It offers quick recovery and strong insurance acceptance.

Sclerotherapy

Doctors inject a medical solution to close smaller varicose veins and spider veins. Insurance may cover it for symptomatic veins.

Ambulatory Phlebectomy

This outpatient procedure removes surface varicose veins through tiny incisions and is often insurance-approved.

Vein Treatments for Spider and Varicose Veins

Not all vein conditions qualify for insurance coverage. Vein Treatments for Spider and Varicose Veins differ based on severity. Spider veins typically fall under cosmetic care and are not covered. However, larger varicose veins associated with pain or circulation issues often qualify for reimbursement.

A skilled vein specialist evaluates both medical need and cosmetic concerns to create a balanced treatment plan.

Why Choose a Specialized Vein Treatment Center?

A dedicated vein treatment center improves both treatment outcomes and insurance approval success. Specialists understand insurance requirements, handle documentation, and submit pre-authorizations accurately.

At **Vein Treatment New Jersey **, patients receive advanced diagnostics, state-of-the-art procedures, and insurance guidance in one convenient location.

Final Thoughts

So, are varicose veins covered by insurance? In many cases, yes—when symptoms affect health and daily life. Coverage depends on medical documentation, diagnostic testing, and approved treatment methods. Consulting an experienced vein specialist ensures accurate diagnosis, effective care, and the best chance of insurance approval.